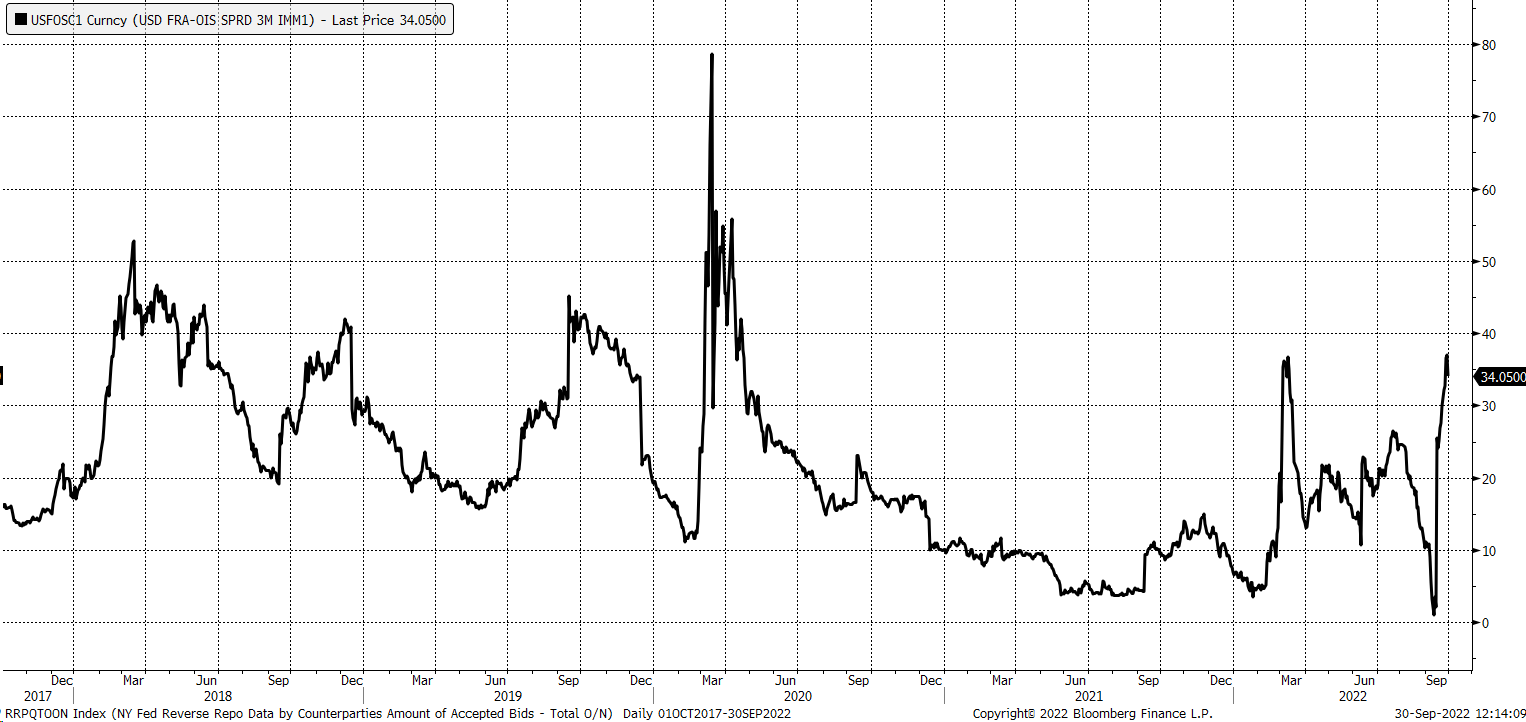

The multi-curve framework is a direct consequence of financial crisis of 2007-2008 when the so-called 'Libor market' - represented by single yield curve stopped being seen as risk-free, and new curves started to emerge to better reflect the counterparty risk in the financial markets. We review the setting of Interest rate derivatives in post-crisis era characterised by multi-curve environment where dedicated yield curves are defined for forward rate estimation and cashflow discounting. Various modelling assumptions are used to show derivatives pricing in this new setting.

We show how multiplicative adjustment works in this new setting and how interest rate derivatives are affected. The changes in the forward Libor estimation are due to the loss of martingale property when mono-curve world is replaced by multiple curve framework. The first is generally assumed to be the OIS curve, whilst the rest are tenor curves for given Libor tenor. This is characterised by presence of several curves a dedicated discount curve and set of estimation curves each for specific Libor rate. We discuss the changes to the interest rates processes when we move from mono-curve setting to multi-curve framework.

Finance, Statistics & Business Analysis.Wolfram Knowledgebase Curated computable knowledge powering Wolfram|Alpha. Wolfram Universal Deployment System Instant deployment across cloud, desktop, mobile, and more. Wolfram Data Framework Semantic framework for real-world data.

0 kommentar(er)

0 kommentar(er)